Year-End Strategy #4: Should I “Gift” as an Estate Planning Strategy?

Implementing a strategy for gifting money during your lifetime can be a way to reduce your taxable estate and help loved ones sooner than later.

It’s the season of gift giving and a time to reflect on how we want to express gratitude and generosity to others, especially loved ones. In addition to the gifts we wrap, many also use this time to evaluate their long-term financial plan for sharing the wealth they’ve accumulated during their lifetime and reducing the potential future taxability of their estate.

Understanding the Lifetime Gift Exemption—and Possible Changes Coming in 2025

The Lifetime Gift Tax Exemption is the amount of money the federal government allows to be transferred at death or over the course of an individual’s lifetime free of tax. The 2018 Tax Cuts and Jobs Act increased this exemption to a historical high. In 2021 it is set at $11.7 million for individuals and $23.4 million for married couples. (This will increase to $12.06 million in 2022 for individuals and $24.12 million for couples.)

Assets exceeding the lifetime gift tax exemption are subject to a hefty gift and estate tax of 40%. A “generation-skipping transfer” tax of 40% is applied to inheritances that skip a generation (e.g., grandchildren or great-grandchildren).

Many people might shrug this off, thinking that it is unlikely their estate will ever exceed the level of assets defined by the current exemption. However, the current lifetime gift exemption is set to expire after 2024. If Congress does not make any changes (and there have been no moves in this direction to date), it is projected to return to its pre-2018 level of about $6 million.

We note this not to sound an alarm but rather to make sure it’s on the radar for families who may have estates closer to the $6 million range and may be impacted by such a change. The possibility of an exemption reversion may motivate some to move forward more proactively now to use gifting as a tool to reduce their taxable estate.

The Annual Gift Tax Exclusion: A Tax-Free Gifting Opportunity Today

Whether or not possible changes to the lifetime gift tax exemption is a concern, some individuals and couples do decide to make substantial financial gifts during their lifetime. The Annual Gift Tax Exclusion defines the amount that any individual can give to another individual tax free each year without notifying the IRS and applying the amount to their lifetime gift exemption.

The annual gift tax exclusion is currently $15,000 per gift recipient per year and will increase to $16,000 in 2022.

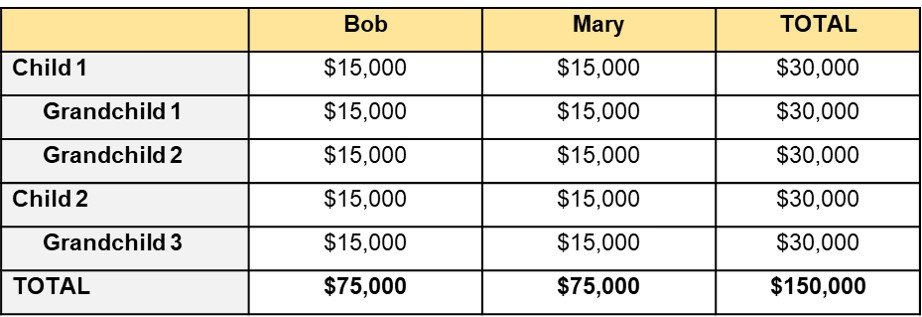

So, for example, in 2021 a couple—let’s call them Bob and Mary—with two children and three grandchildren could together gift up to $150,000 without tax implications.

If this gifting strategy is implemented each year over 10 years, Bob and Mary could reduce their taxable estate by $1.5 million. It’s a fairly simple way to make an estate more tax efficient while also helping to educate children and grandchildren about values surrounding money and providing additional financial support.

It should be noted as well that cash gifts are not limited to family members but may be given by any individual to another.

The Gift of Education through a 529 College Savings Plan

One practical application of the annual tax exclusion is to make up to a $15,000 contribution each year (up to $16,000 in 2022) to a 529 College Savings Plan for a child, grandchild, or other family member (see complete eligibility list HERE). Using a 529 plan as a gifting vehicle ensures that the money is directed toward educational purposes. Any investment gain resulting from the 529 contribution and applied to education expenses will not be taxed. And in many states, there is a state tax deduction for contributing to a 529 plan in that state—an additional bonus.

There is also a provision that allows donors to “super fund” a 529 College Savings Plan with a single, five-year contribution—for a total of $75,000—up front. Once completed, no additional contributions are allowed for the next five years. This can be a great way to jump start college savings for a child or grandchild while also transferring assets as part of a long-term estate planning strategy.

What NOT to Gift: Appreciated Non-Cash Assets

We’ve reviewed the ways that individuals can make cash gifts to others during their lifetime. But what about gifting other types of assets like stock or property? While well intentioned, this is rarely a good idea.

The reason for this strongly worded answer has to do with rules around the concept of “step-up cost basis.” If you gift an appreciated asset while you are still living, your original cost basis for the asset travels with the gift—and the gift recipient will receive the tax bill on any gains when that asset is liquidated. Alternatively, at your death, the original cost basis for the same asset receives an automatic “step up” to current value, thus eliminating any taxable gain for heirs. Waiting until after death to transfer these types of appreciable assets can result in a much lower tax bill.

For example, gifting stock with an original cost basis of $20 per share but a current value of $180 per share will create a significant taxable gain if transferred while the original owner is still living. That same stock gift will not be taxable if it conveys as an inheritance with the estate after the original owner passes. The same holds true for property (e.g., transferring the title of a home to a family member) or other non-cash investment assets.

Custom Legacy Planning Solutions

This newsletter touches on some high-level considerations for simple, annual gifting. However, for more complicated situations and estate planning strategies, there are other options to consider. We are happy to consult on your specific situation, working in partnership with the Wealth Management team at Raymond James to design custom legacy planning solutions.

Any opinions in this newsletter are those of Estes Wealth Strategies and John Estes and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information presented herein has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. It is not a statement of all available data necessary for making a recommendation, nor does it constitute a recommendation.

While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.

As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. The tax implications can vary significantly from state to state.