The Silver Lining of Higher Interest Rates: Earning Opportunities for Cash

There is a silver lining in the volatility caused by this higher-interest-rate environment, and it revolves around the newly revived earning potential of cash savings. After many years languishing in zero-interest-rate accounts, cash now has exciting opportunities to earn a healthy return—upwards of 4 to 5%—without sacrificing safety or your personal liquidity needs. Through Raymond James, we can offer a spectrum of options to address your specific cash management objectives.

Strategic Cash Savings Options

We are working with many clients on more strategic ways to deploy cash that may be losing to inflation in a low-interest savings account at the bank. Here are some options to consider:

Money Market Mutual Funds

These are low-risk securities that invest in highly liquid, short-term instruments. They are intended to be stable, provide a high degree of safety and liquidity, and pay a current rate in interest. Funds can be sold and transferred in one to two days.

Taxable money market funds are currently providing an annual return similar to CDs but with the feature of daily liquidity. Please call us for the latest rates.

Tax-exempt money market funds provide a lower return than taxable funds but, depending on an investor’s tax bracket, may deliver a higher taxable equivalent yield overall. These may be attractive for investors in higher tax brackets.

As with other securities, money market funds are not insured against loss (however, SIPC insurance provides limited coverage in the event of institutional insolvency). That said, these funds are generally considered very safe.

Certificates of Deposit (CDs)

Unlike money market mutual funds, CDs offer a guaranteed return with no risk of loss so long as the funds are held until maturity. Investors who withdraw funds before maturity risk market loss. A wide range of maturities—from three months to five years—is offered to match investor investment objectives. CDs are FDIC insured up to $250,000. A minimum quantity may apply.

Normally, the longer the term of the CD, the higher the interest rate—which makes sense from the standpoint that you are being paid based on the commitment of funds. However, we have the unusual situation right now where short-term CDs with durations under a year are offering more attractive rates of nearly 5.00% annual percentage yield (APY). So, with a relatively short-term commitment of funds, you can earn a fairly substantial return. We participate in a multi-bank program that can utilize up to 40 CDs and insure up to $10 million dollars.

Treasury Bills (T-Bills)

A Treasury Bill, or T-Bill, is a short-term debt obligation issued by the U.S. government. Of all government debt securities, T-Bills have the shortest rate of maturity, ranging from a few days to one year. Based on the short term of the debt and the U.S. government’s low risk of default, they are generally considered very safe. Like CDs, 3-month T-Bills are currently paying around 5.00% annual percentage yield (APY). They are guaranteed and have no limits.

*********************

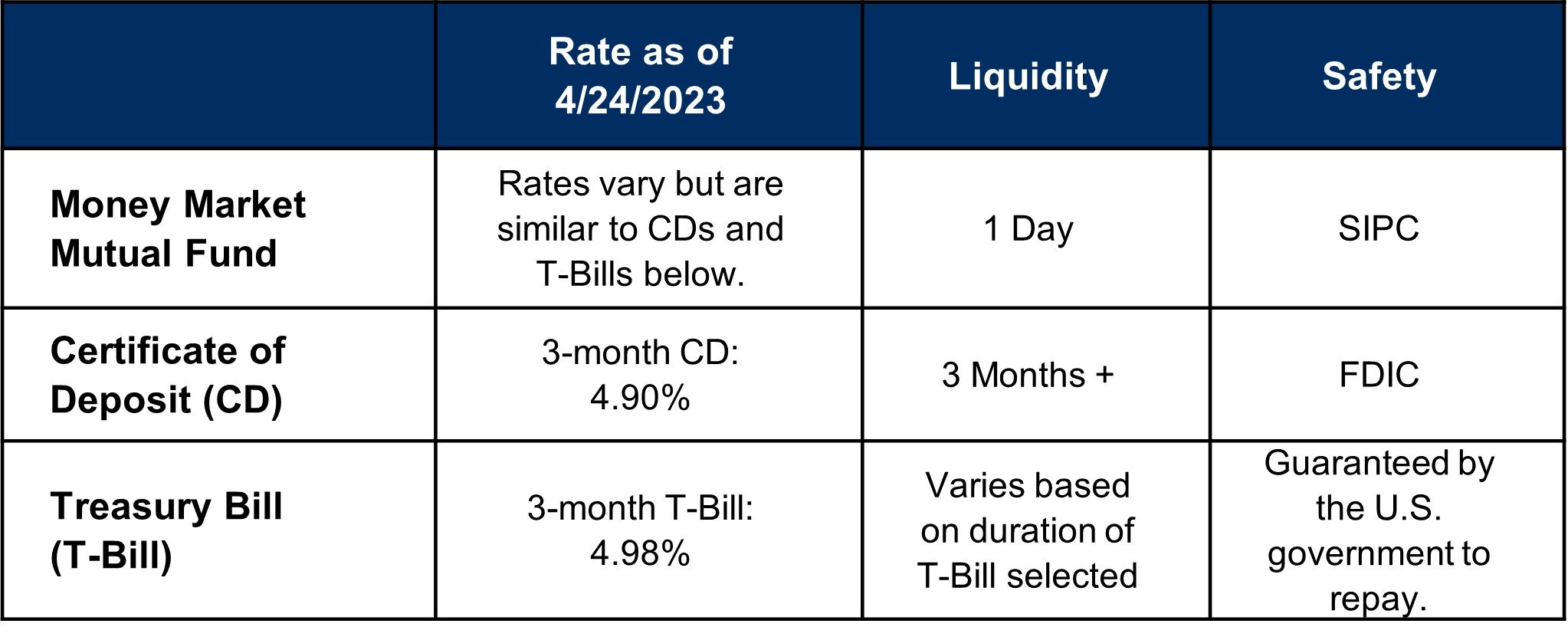

The chart below provides a summary of these three options. Depending on your cash objectives, we can help determine which investment—or combination of investments—is the best fit for your situation. Feel free to give us a call to discuss.

Raymond James Bank Enhanced Savings Program

Raymond James Bank recently announced a new Enhanced Savings Program for high-net-worth individuals and businesses that maintain a large cash position, wish to earn higher yields than offered by the typical bank savings account, and desire more safety than the standard FDIC insurance limit.

Through May 31, clients who link their Raymond James brokerage accounts to a high-yield Raymond James Bank account are currently eligible to earn 5.00% annual percentage yield (APY) qualifying cash.* This rate, which is current as of the publication date of this newsletter, is variable and may change after the account is open. There are no bank fees or holding period requirements. Funds are placed at a network of FDIC-insured banks, allowing for combined FDIC insurance up to $50 million. The minimum starting deposit to participate in the Raymond James Enhanced Savings Program is $100,000.

If you or your business is interested in learning more about this enhanced savings solution, we are happy to discuss with you.

* Qualifying cash may vary. Deposit eligibility currently includes cash from external sources or net-new proceeds from sale of securities (e.g., money market funds) – increasing cash sweep balances – held in RJ brokerage accounts as of March 1.

Raymond James Bank Enhanced Savings Program offer is subject to availability. Terms and conditions apply. Interest rate may change after the account is opened.

Cash on deposit at FDIC-insured institutions through the Enhanced Savings Program offered by Raymond James Bank is insured by the FDIC up to $250,000 per insurable capacity per depository institution (bank), subject to applicable FDIC rules and limitations. The Enhanced Savings Program relies on the services of IntraFi Network, LLC for the placement of deposits at a network of third-party FDIC-insured depository institutions. The current list of FDIC-insured depository institutions in the network is shown at https://www.intrafinetworkdeposits.com/ find-intrafi-network-deposits. Raymond James is not affiliated with IntraFi Network, LLC.

Raymond James Capital Access Banking Solution with Free Checking and Bill Pay

As someone who is familiar with Raymond James’ investment and brokerage services, you may not realize that we also offer a Capital Access banking solution for your cash management needs. Capital Access comes with a host of features and benefits, including:

Convenient, online access through your Raymond James Client Access website

VISA® Platinum debit card with ATM fee reimbursement*

Free bill pay**

Mobile check deposit

Free, unlimited check writing

24/7 customer service support

The first year is free. The annual fee of $150 is waived if direct deposits average $1,000 a month or the client relationships has a market value of $500,000.

If you are interested in streamlining your finances with all-in-one brokerage and banking, we are happy to help you get set up.

*Up to $200 annually for standard accounts; unlimited reimbursement for relationships with market value over $500,000.

**Bill pay is available for domestic clients with a social security number and U.S. address.

Any opinions in this newsletter are those of Estes Wealth Strategies and John Estes and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information presented herein has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. It is not a statement of all available data necessary for making a recommendation, nor does it constitute a recommendation.

© 2023 Raymond James Bank, member FDIC. Raymond James® is a registered trademark of Raymond James Financial, Inc. Raymond James & Associates, Inc., and Raymond James Financial Services, Inc., are affiliated with Raymond James Bank. Unless otherwise specified, products purchased from or held at Raymond James & Associates or Raymond James Financial Services are not insured by the FDIC, are not deposits or other obligations of Raymond James Bank, are not guaranteed by Raymond James Bank, and are subject to investment risks, including possible loss of the principal invested. Banking and lending solutions are offered through Raymond James Bank, an affiliate of Raymond James & Associates, Inc., and Raymond James Financial Services, Inc. Investing involves risk, and you may incur a profit or loss regardless of strategy selected.

© 2023 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. © 2023 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment products are not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.